A Private Favor for Putin

The story of how PrivatBank is helping the Kremlin to cash money out of Ukraine.

Managers of the nationalized PrivatBank helped the Russian Sberbank get 500 000 million UAH of the non-performing loan back and saved Poroshenko’s friend from going bankrupt. It all was done at the expense of our state.

In March 2017 five banks with Russian state assets were subject to sanctions for the period of 1 year. They were Sberbank, VS Bank, Joint Stock Commercial Industrial & Investment Bank, VTB Bank and BM Bank.

Petro Poroshenko excitedly stated back then that those sanctions were the means to prevent cashing out of the Kremlin money from Ukraine. But that excitement turned into a lie as usual.

At first, despite its own requirements to prevent outflow of Russian state banks’ capital from Ukraine, the National Bank of Ukraine allowed Sberbank to sell VS bank to Serhiy Tyhypko since that bank belonged to Sberbank.

However, there’s an interesting incident that has come to the surface. It concerns loans of that same Sberbank being refinanced by Privatbank. Let me explain this to the inexperienced readers: the aforementioned situation means that the nationalized bank gives out loans to clients of Russian Sberbank at the expanse of Ukrainian budgetary funds so that those clients could pay off their debts to Sberbank and give cash money back.

For instance, according to my information, in 2017 the nationalized PrivatBank helped the Russian Sberbank get almost 0.5 billion UAH back as debt repayment of the Group of Companies UkrAgroCom at the expense of state funds.

Moreover, when being refinanced by PrivatBnak the companies of UkrAgroCom had obvious troubles: the loan of the Russian Sberbank that was assumed by PrivatBank had been non-performing since 2014. Let me explain it one more time: such a situation means that the nationalized PrivatBank assumed a non-performing debtor in the person of Sberbank of Russia that came clean out of the default credit project with cash money.

Why did they decide to help UkrAgroCom settle up with Sberbank of Russia? The explanation to this success story consists of at least two components:

The 1st one is as follows: The owner of UkrAgroCom is Anatolyi Kuzmenko, Ukrainian Deputy from Petro Poroshenko Bloc. His son Serhiy Kuzmenko (he is also a beneficiary of several enterprises of UkrAgroCom Group) was assigned as chairman of Kirovohrad Regional State Administration in 2014 upon the order of Petro Poroshenko.

You can’t but agree that it’d be rather difficult to explain such impetuous career advancement of Anatolyi Kuzmenko’s son by anything else other than friendly relationship between Anatolyi Kuzmenko and President Poroshenko.

The 2nd one is as follows: the problem of UkrAgroCom was dealt with by Oleh Sergeyev, First Deputy Chairman of PrivatBank Executive Board, who had built a business on giving out non-performing loans.

PrivatBank refinanced the accounts payable that UkrAgroCom had owed to Sberbank of Russia back in 2012 and 2013. And the whole refinancing process was controlled exactly by Oleh Sergeyev.

In 2017 UkrAgroCom Group had to repay a number of loans for 784mln UAH to Sberbank. The loans were received for the construction of Svitlovodsk river terminal.

However, the company lacked available working capital to repay those loans so one part of them was prolonged and the other part was repaid at the expense of the funds possessed by Privatbank.

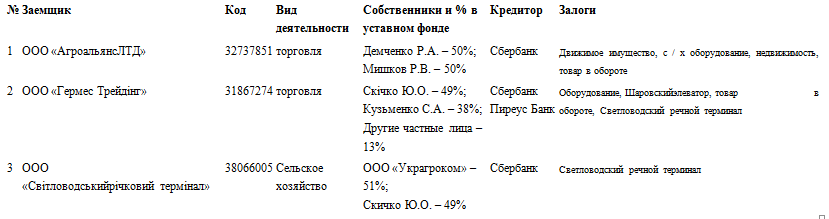

The loans given by PrivatBank were needed for the following companies of UkrAgroCom Group:

Total amount of debts reached 456mln UAH. So Oleh Sergeyev suggested that the executive board of PrivatBank should set a limit in the amount of 476mln UAH for the enterprises of the group so that it’d be possible to get foreign currency for debt refinancing for a term of 5 years.

To understand the essence of such a case you should pay attention to the following fact that is rather amusing: 28mln UAH was planned to be allocated for working capital refinancing of Kuzmenko’s enterprise called LLC Kolos (Code No. 30702701)

A grain combine harvester Tukano 470 and a soy header Flex S750 were used as collateral for the loan. As at 2014 the estimated by the bank value was 4mln UAH. It means that the sum of the loan was 6 times bigger than the value of the collateralized property.

The situation that happened to the collateralized property for the loans taken by the company to refinance accounts payable owed to Sberbank was even more entertaining.

In May 2017 the estimation of the collateralized property of UkrAgroCom was performed by the appraiser from VP Consulting that was not accredited by PrivatBank. Svetlovodsk river terminal was estimated by that appraiser at 607mln UAH.

Where that sum came from was a mystery since the funds collateralized for Sberbank loan were similar to those offered to PrivatBank based on the loan offer.

So the process of refinancing had to involve the second collateral and its value had to be estimated by the PrivatBank accredited appraiser.

When it came to the land owned by LLC Svetlovodsk River Terminal the situation was just the same. They needed a second mortgage contract since the terminal was collateralized for the loans given to Sberbank. However, the appraiser didn’t ask for that kind of a contract as well.

And there’s the most interesting part: the accounts payable owed by UkrAgroCom to Sberbank and PireusBank that were later assumed by Privatbank were never repaid.

And at the time when the credit application was under consideration the total accounts payable owed by UkrAgroCom Group to Sberbank, Pireus, PUMB, Credit Agricole and Ukrgasbank (to be repaid within the year of 2017) comprised 784mln UAH.

In the period from 2014 to 2015 UkrAgroCom Group suffered losses that reached:

- 355mln UAH in 2014 (net return was -16%)

- 81mln UAH in 2015 (net return was -3%)

It’s not quite clear how but UkrAgroCom Group managed to suddenly turn from a company losing millions UAH into a profitable enterprise with net return of 6% and annual income of 255mln UAH based on the economic rates provided by PrivatBank to the Credit Committee in 2016. Knowing what sort of person Mr. Sergeyev is, one shouldn’t be surprised, though. I have already published the information covering his activity on giving loans upon fake background certificates and collaterals. So, fake income rates that appeared in the list of his ‘achievements’ seemed quite logical.

In additions, to cover up the activity of the Group in 2018 the management of UkrAgroCom resorted to judicial restructuring of assets. As a result LLC Agrovista was allowed to purchase shares included in the authorized capital of LLC Korolivske HPP and LLC Hermes-Trading (more than 50% of votes) and to gain sole control over LLC Svitlovodsk River Terminal.

Comments