The National Bank issues a negative forecast for the banking system by the end of 2020. But it doesn’t say how many banks are to close

The working conditions of the banking sector of Ukraine will deteriorate significantly by the end of 2020. Such a forecast was issued by the National Bank in its May report published today.

“Restrictive quarantine measures and the related economic decline will temporarily reduce the demand for banking services. Fee and commission income from banks is likely to decline compared to last year. Demand for investment loans has fallen and will not recover until the end of the year,” it says.

National bank employees concede the demand to remain only for financing working capital, but urge banks to continue lending to the economy no matter what.

The NBU said that according to the results of the first quarter of 2020, the profit of the banking system amounted to UAH 16 billion, although they immediately recognized that most of the earnings came from the nationalized Privatbank. And it earned most of the money on government bonds. As it is known, the government contributed these government bonds to the bank’s fund. The real operating profit of the financial institution has not been increasing very actively. Banks had to bear heavy expenses.

According to the NBU, the number of unprofitable banks in the first quarter of 2020 increased from 6 to 14. Their total loss amounted to UAH 2.7 billion.

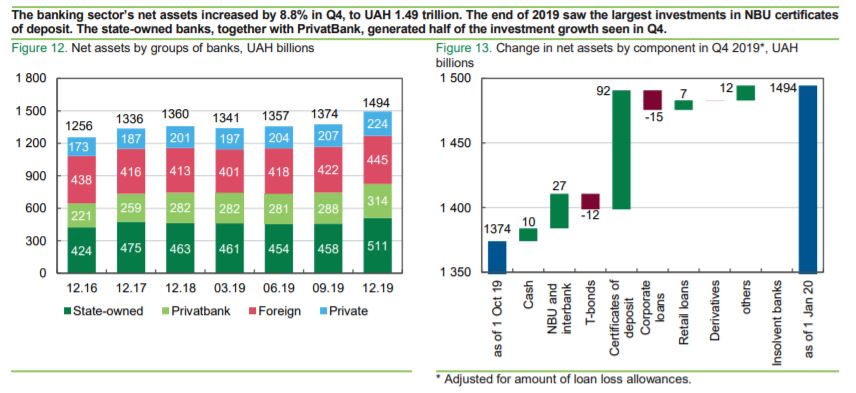

The assets of the banking system have increased, but the regulator acknowledged that this happened due to the devaluation of the hryvnia, which was observed at the beginning of the year.

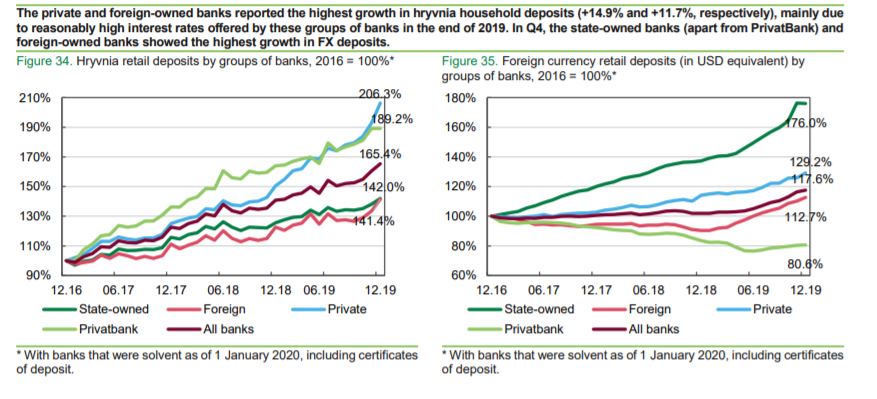

The funds in the accounts of enterprises have reduced significantly. Due to the quarantine, the Ukrainian economy stopped, and business was largely inactive - it has not been making any profits. Its deposits went to cover mandatory payments in order not to close and to pay minimum wages to the staff. Workers were laid off and the production was shut down everywhere. Accordingly, funds were washed out of accounts: according to NBU’s statistics, in March, 7.4% of investments were taken out from the hryvnia business accounts, and in the first quarter - 6.4%. Privatbank was badly hit showing a “minus” of 12.5%, as well as private banks - a “minus” of 10.6%.

The decrease in the National Bank's discount rate (by 3.5%) for the quarter greatly reduced the income of depositors. The average yield of the hryvnia deposit of individuals decreased by 3.2% - to 11.9% per annum, legal entities - by the same 3.2% (up to 7.1% per annum). At the same time, lending rates decreased not so actively - by 1.7% and only for enterprises - to 13.9%. The population continues to seriously overpay for bank loans. The average rate is 34%, and the maximum exceeds 100% per annum.

The National Bank began to speak a little more frankly about the negative prospects of banks. They still have not recognized the depth of the disaster, but at least they started talking about problems. Indeed, the growth of loan defaults is inevitable due to the closure of enterprises and the stoppage of small and medium-sized businesses - it will collapse due to the decrease in the purchasing power of the population. People are being laid off and salaries are being cut. This phenomenon is becoming increasingly widespread.

At the same time, the NBU is afraid to admit that the banking system will need significant capitalization. “Most banks will be able to overcome this crisis without attracting additional funds,” the forecast of the National Bank says.

Not just a controversial statement, but frankly a false one. Not in the least because the consequences of the crisis for the country's economy are still not fully understood due to the unpredictability of the quarantine’s duration, which promises to constantly be extended depending on the growth / decrease in the incidence of COVID-19.

The banking regulator is trying to reassure the public refusing to recognize the obvious. The Ukrainian economy has not yet hit the bottom of the economic crisis, and when and how it will - no one knows. Therefore, one cannot say what capitalization banks will need, how many of them will be able to allocate funds for it, and how many will be forced to close.

Andrey Pshenichny for the site dubinsky.pro

Comments