The Chocolate Avenger

At this very moment State Fiscal Service of Ukraine is doing unscheduled check-outs of ROSHEN Confectionary Corporation belonging to Petro Poroshenko. What is this all about?

All of the check-outs are given a start due to the check-out declaration from the managers of the corporation. The check-outs are needed for ROSHEN to continue its business with no interference in the next three years after the presidential elections. In accordance with the Tax Code, period of limitation on tax liabilities cannot exceed 1095 days.

Thereby current check-outs of ROSHEN will shut the check-out period down for three years. And there will be nothing tripping the corporation up in the nearest future in case of power shifting in the state. Moreover, the audit materials covering former years will sink into oblivion at all.

If we try to analyze all of the mechanisms used by Poroshenko’s team to avoid additional tax payments, we can come to several important conclusions:

-

It’s possible to dust off the materials covering ROSHEN tax audit for 2013 right away after the elections and make Poroshenko pay 100 mln UAH to the budget.

-

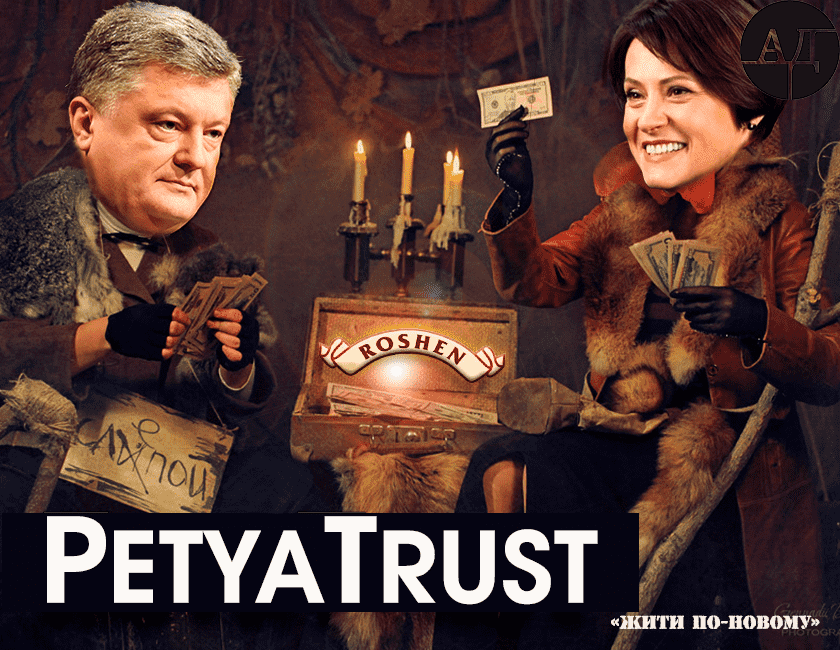

The mythical Rothschild and the blind trust exist only for dupes in order to avoid paying taxes to the state budget of Ukraine.

At the moment the corporation is under the direct control of Poroshenko and the audit is being controlled by his personal accountant named Nina Yuzhanina. She also holds a position of a chairman of the Committee on Tax and Customs Policy at Verkhovna Rada of Ukraine.

Right now I’m going to give you several examples demonstrating how Mr Poroshenko

-

avoided tax paying

-

controlled all of the financial affairs of ROSHEN Corporation before and after the blind trust

-

retaliated against tax officers

right after his inauguration.

Example 1

Due to the investigation on ROSHEN tax audit legitimacy conducted from 2010 to 2013 Nina Yuzhanina gave an orders to Yuriy Buglak, a legal councillor of ROSHEN Corporation, (at the moment he holds the position of a PPB deputy (Petro Poroshenko Bloc) and he is also a chairman of the Subcommittee on Opposition and Prevention to Political Corruption of the Cabinet of Ministers Committee on Opposition and Prevention to Political Corruption) to do corrections to the evidence given by Galina Boyeva who held the position of a chief accountant at the ROSHEN Corporation affiliate. That order was issued on May 27, 2014.

In fact the accountant testified about the ROSHEN check-out that started in August 2013. At that time numerous tax inquiries paralyzed the whole corporation literally.

In course of the investigation the required report was drawn up on December 6, 2013. It contained the information about 107 mln UAH of the additional tax payment.

Another off-schedule on-site inspection was conducted upon ROSHEN’s request to revise the conclusions of the report dd 06/12/13. But the amount of the fine was limited only AFTER the revolution. The additional tax payment was reduced 100 times and resulted into 0.9 mln UAH that was paid to the budget.

Apparently such a reduction of the fine had no legal grounds. That’s why Mrs Yuzhanina was trying to conjure the needed information out of thin air that would confirm the ‘pressure’ ROSHEN had felt from the tax inspectorate in the times of Viktor Yanukovych.

To reach that aim Mrs Yuzhanina prepared the evidence for the Ministry of Internal Affairs and Attorney General’s Office in May, 2014 in person. Mr Buglak was the one to edit and send the evidence. Supposedly that part of a deal led him to that very position of the Chairman of the Subcommittee on Opposition and Prevention to Political Corruption I already mentioned.

At the same time ROSHEN employees were giving their evidence in such a way that would make it easier for the Ministry of Internal Affairs to begin a criminal proceeding against the tax office. Moreover, it involved not only its managerial board but also ordinary tax officers.

Based on the received information in August 2014 Ministry of International Affairs prepared an inquiry to seize documents and evidence from one of the enterprises of the Corporation. The enterprise was ROSHEN- KRYVBAS. That inquiry passed through Yuzhanina as well.

Except the constituent documents to be given there was one more request in that inquiry dealing with the investigation of the criminal proceeding against officials who had organized the checkup of ROSHEN in the period from 2013 to 2014. The investigator from Central Investigation Department of the Ministry of Internal Affairs asked for the surnames of all the tax inspectors, who had participated in the inspection, and every employee, who had been in contact with them.

Each and every piece of that information was under personal control of Nina Yuzhanina and Alexandr Kareyev, Senior Investigator of Central Investigation Department at the Ministry of Internal Affairs of Ukraine, who had a direct communication with her per E-mail.

Example 2

On July 30, 2015 Lyudmila Udovychenko (Managing of one of the companies belonging to Poroshenko) addressed to Yuzhanina as to the off-schedule check-out of LLC ROSHEN-ZODIAK to be conducted by the Central Department of the State Fiscal Service in Kyiv region (Bila Tserkva). Udovychenko sent a letter describing reasons for the check-out that took place due to purchase of primary equipment for the company (a car, office equipment etc.).

Equipment costs were 0.8 mln UAH according to the declaration (March 2015). Such a manipulation entailed VAT negative value for that month as the expenditures were reported in the declaration and as a result it all increased tax credit of the enterprise.

In other words such expenditures were not connected to the acquisition of income at that moment. Since the company had just started to work there could be no income in March 2015 at all.

The check-out was given a start on June 6, 2015 and then prolonged by the order dd July 13, 2015. Apparently, the prolongation took place as the documents had not been provided.

As the negative value in the tax declaration (0.8 mln UAH) would lead to blocking the operations, VAT payment and fines, Nina Yuzhanina redirected the notification to Nataliia Ruban, Head of the Audit Department of the State Fiscal Service of Ukraine on July 31, 2017 with a request to check that information in order to solve the issue.

Nina Yuzhanina was managing ROSHEN’s business while holding a position at the Customs Committee and that fact was supported by regular correspondence of the corporate heads:

-

Tamara Kozinets, Chief Accountant of the Distribution Center ‘Plus’ notified the chief accountant of LLC ‘Konditer-Trans’ (belonging to Poroshenko through ROSHEN) and Lyudmila Udovychenko about her intentions to give explanations to the State Fiscal Service according to the inquiry (concerning the tax credit formation) and asked to check the documents in her letter dd October 5, 2016 (the e-mail subject was ‘State Fiscal Service Check-out’). In its turn Udovychenko redirected the letter to Yuzhanina for approval.

In general, all of the financial and economic affairs of the corporation were conducted with the involvement of Nina Yuzhanina. And when the inquiries about charges (like income tax or VAT) were coming in, the information was sent not to the Rothschilds as ROSHEN’s President Mr Moskalevsky usually lied in the interviews, but to Poroshenko’s chief accountant, when there appeared an opportunity to steal 3.6 mln UAH or punish a tax officer.

Example 3

The Ministry of Revenues and Duties of Ukraine headed by Klymenko (who is a runaway at the moment) conducted check-outs at the enterprises of ROSHEN Confectionary in 2013. It all resulted into 47 mln UAH of the additional tax payments.

In accordance with the adjudication record data 2010-2012, the tax office in Ivano-Frankivsk conducted the check-out of LLC ROSHEN-Prykarpattya for observance of tax laws. A corresponding report for additional payment was drawn up in September 2013.

Here below you can find main violations revealed:

-

Purchase of goods by LLC ROSHEN-Prykarpattya from ROSHEN Confectionary Corporation Affiliate and purchase of services for further selling of those goods to non-resident LLC ROSHEN were not connected with business activity of LLC ROSHEN-Prykarpattya (the so-called false sale operations). In accordance with the terms of the agreements the goods were stored by the Commission Agent (ROSHEN Confectionary Corporation Affiliate) at LLC Distribution Center ‘Plus’ (Kyiv region, Yagotyn) till they were shipped to LLC ROSHEN that was non-resident. At the same time storage and shipping of goods for export were conducted by ROSHEN Confectionary Corporation Affiliate with no LLC ROSHEN-Prykarpattya involved.

-

Purchase of marketing services by LLC ROSHEN-Prykarpattya under the corresponding contracts concluded with private entrepreneurs was faked as the indicated individuals stayed in the employment relationship with LLC ROSHEN-Prykarpattya. The administrative duties of the latter were similar to the provided services specified in the service contracts. Starting from May 5, 2014 ROSHEN-Prykarpattya won the lawsuit according to Ivano-Frankivsk Regional Court ruling. It stated the obligation of the additional payment in the amount of 3.7 mln UAH assessed in the course of tax audit to be recognized illegal and the decisions to be annulled no matter how hard fiscals tried to appeal against such a decision in future.

Well the interesting part of this story is not in the fact that Poroshenko had no intentions to pay money to the budget as he’s already used to NOT doing that. What really shocks is that ROSHEN-Prykarpattya initiated a pre-trial inquiry No.12015000000000435 dd July 15, 2015 involving criminal offence regardless of the complete victory in the lawsuit. And it all was done with the help of public prosecutor’s office.

The aim of such actions was to give way for the investigative powers of the prosecutor to make a search in the apartment of the ordinary tax officer who had been a member of the check-out team of the Ministry of Revenues and Duties of Klymenko times.

The search aimed at not only at hiding tax cheating but also at finding and seizing the computer equipment used by tax officers to draw-up the check-out report.

On becoming a President Petro Poroshenko started to take vengeance even on ordinary tax officers. A standing ovation to the Protector of the Constitution!

Comments